- Soft pricing in the shipping sector will continue in 2024 and could linger into 2025, according to Alan Baer, CEO of OL USA, as capacity in the logistics sector continues to outstrip weaker demand.

- The trucking sector, already facing extreme financial stress, expects lower freight orders and revenue this holiday season.

- A new CNBC Supply Chain Survey indicates no growth for the first half of 2024, and at best a mildly positive turn in the second half of the year.

The global shipping industry has been mired in a freight recession this year and the challenging economic conditions will continue into 2024, according to a new CNBC Supply Chain Survey. High inventories and a pullback in consumer spending are reasons behind the bearish outlook.

The CNBC Supply Chain Survey was conducted October 21-October 31 among logistics executives who manage freight manufacturing orders and transportation, including those at C.H. Robinson, SEKO Logistics, DHL Global Forwarding Americas, Kuehne + Nagel, OL USA and ITS Logistics. These companies have insight into the orders shippers place into manufacturing companies around the world because they pick up the product from the ports as well as distribute products from warehouses to retailers.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

This part of the trade pipe gives investors a three-to-four-month advance insight into retail consumer expectations based on the number of orders placed and the amount of product they have truckers move from the warehouses to the stores. It also provides a read on freight rates and what kind of freight volumes will be moved by truck and by rail — two key revenue drivers for companies in the shipping sector.

Alan Baer, CEO of OL USA, who participated in and reviewed the survey, tells CNBC the results indicate a freight market that will have little to no growth during the first half of 2024, which means stable to downward pricing, and hopes that during the second half of 2024 volume increases.

"Without more freight moving, 2024, and potentially 2025, will continue to see soft pricing as capacity outstrips demand," he said.

U.S. & World

Freight trucking will remain soft

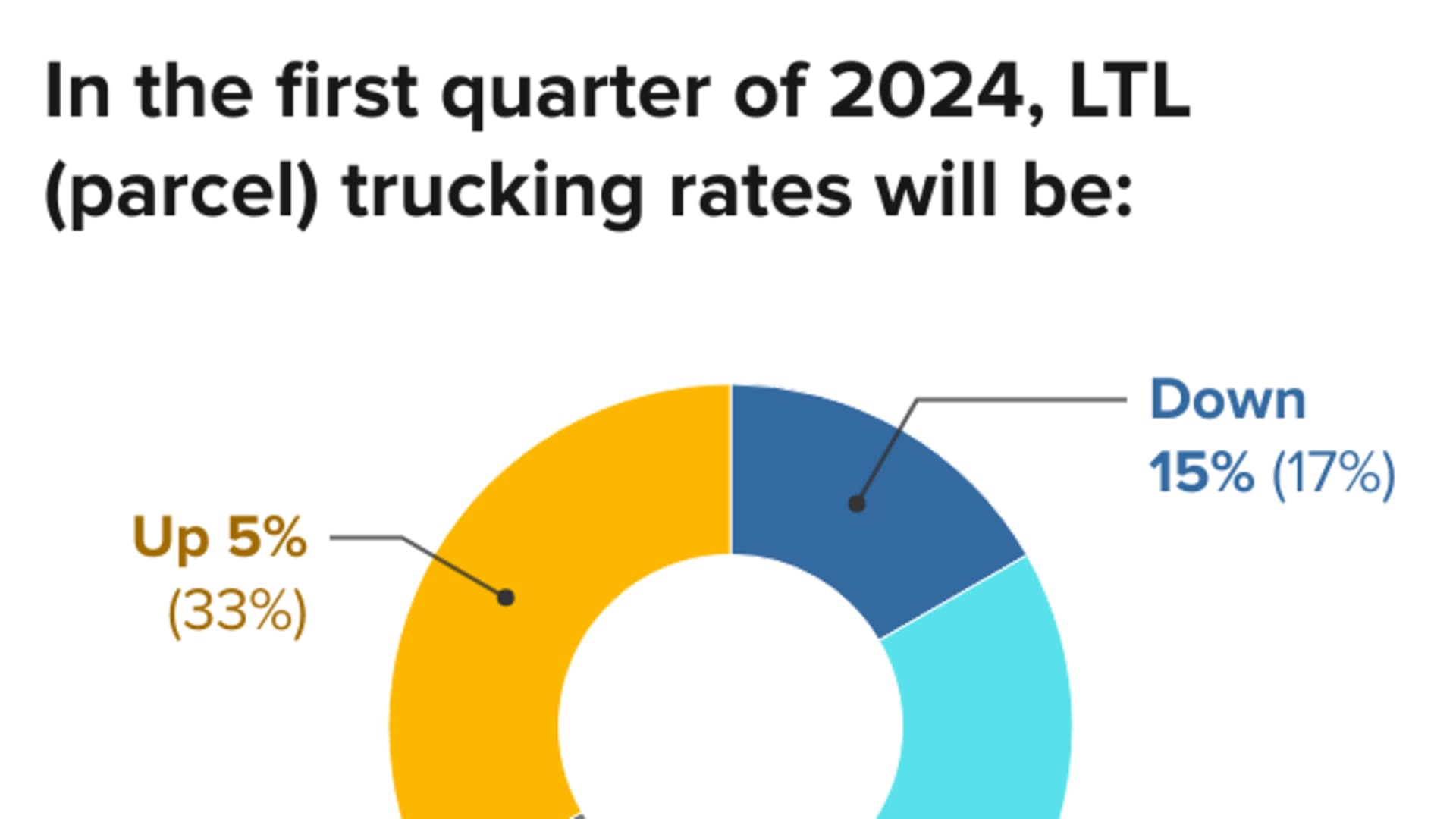

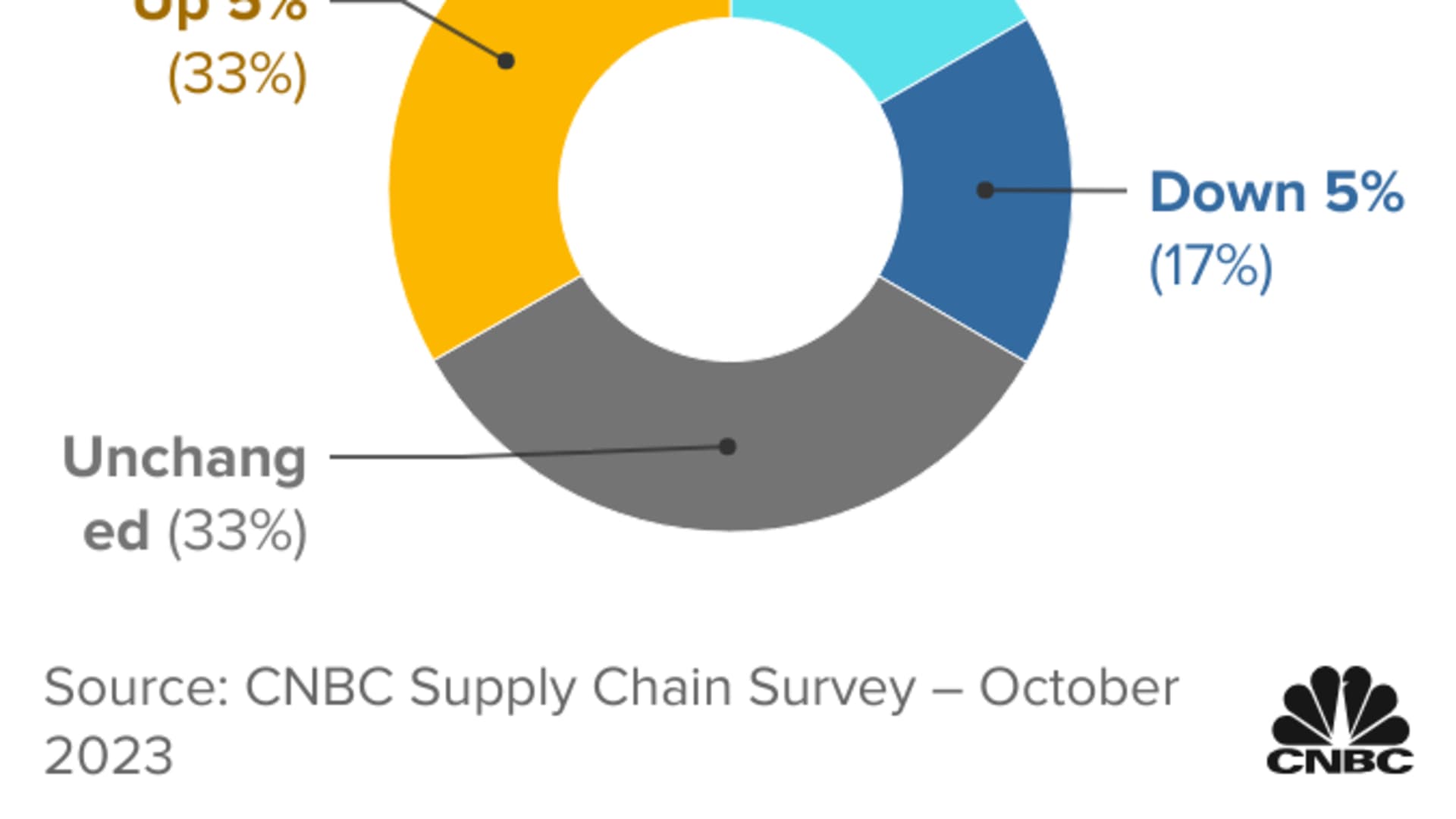

Trucking companies get paid per load, and low expectations for orders imply potentially lower revenue this holiday season. Logistics executives were split on LTL (less-than-truckload) freight rates for the first quarter, with half looking for a 5% bump and the other half expecting rates to be unchanged to down as much as 15%.

The majority believe rates for full truck loads will be unchanged or down, while 33% expect prices to be up marginally at 5%.

"We expect retail peak season for trucking to be sluggish," said Noah Hoffman, vice president for C.H. Robinson North American Surface Transportation.

The freight recession has been hard for the industry and for those companies that were not diversified enough to withstand downturns, leading companies like Jeff Bezos-backed trucking startup Convoy to shut down. According to Tank Transport, rising fuel costs and falling freight rates caused a total of 31,278 trucking companies to either close or shifted their services to larger fleets.

Uber Freight's CEO recently told CNBC that there will be a "new tipping point" in the freight industry shakeout with less diversified business models unable operate on a cost-effective basis.

"No one is projecting confidence about a surge in demand during peak season or into next year," said Tim Robertson, CEO DHL Global Forwarding Americas. He said the CNBC survey results underscore the overall climate of uncertainty that is defining the market right now. Mixed expectations for rates and volumes, and the fact that orders for product categories such as household goods are dropping for some respondents and increasing for others, "tells me companies are making different bets with their inventory strategies," Robertson said.

The survey finds that there is a similarly muted outlook for orders surrounding Lunar New Year, which falls on February 10, with a majority of respondents (67%) not seeing an order increase. As a result of China shutting down the majority of manufacturing operations during the Lunar New Year, shippers start to place their orders now to get their products in before any closures or staffing slowdowns to avoid delays. The products that normally come in during this time are spring and summer items.

A slightly better second half 2024 outlook

The survey shows expectations for a slight turnaround in freight volume in the second half of 2024.

Half of respondents expect a 5% increase; 33% expect a 10% increase; and among the 17% that were the most optimistic, a 15% increase is anticipated.

"With a lot of uncertainty around consumer demand, interest rates and the global economy, most people do not have a positive outlook on freight volumes in the first half of next year, but we could certainly see a rebound in the second half of next year," said Brian Bourke, global chief commercial officer at SEKO Logistics.

In addition to the quantity of freight moved, logistics companies on the water, road, and air generate revenue based on the rates they can charge.

The majority of respondents believe ocean freight prices for the first and second quarters will be unchanged or down — after a 2023 in which rates cratered by as much as 50%. Looking at air freight, the majority anticipate rates to be unchanged to down anywhere from 10% to 20%. FedEx recently told pilots to look for additional work with American Airlines as cargo demand slows.

The low freight prices coupled with diminished cargo volumes were among the reasons behind global shipping bellwether Maersk's recent announcement of 10,000 layoffs. "Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base," CEO Vincent Clerc said in a statement last Friday regarding its results and the job cuts, and he added that overcapacity in most regions had driven down prices.

"Unfortunately, we are going to see significant challenges in volumes, and this will continue to cause more providers to exit the market or implement significant layoffs," said Paul Brashier, vice president of drayage and intermodal at ITS Logistics. "This is not 2008-2009 by any means but it sure feels like it."