The coronavirus pandemic is causing nearly 9 in 10 Americans to feel anxious about money, according to a new survey from the National Endowment for Financial Education.

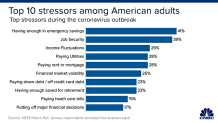

The survey, conducted by The Harris Poll, asked respondents the top five things causing the most financial stress. Concerns about having enough money saved came out on top, with 41% saying they were worried about emergency savings and 23% citing retirement.

Bills also weighed heavily on their minds, with 48% responding they were worried about paying them: 28% cited paying utilities as a top stressor; the same number said paying rent or a mortgage topped their list of concerns

Meanwhile, 39% of employed Americans called job security a top financial concern, followed by income fluctuation, at 29%. The survey polled more than 2,000 U.S. adults online April 7–9, 2020.

The stress levels were the same across all income levels, from those who made under $50,000 a year to those who made above $100,000 annually, said Billy Hensley, president and CEO of NEFE and member of the CNBC Invest in You Financial Wellness Council.

“We’re all affected by this and impacted by this equally,” he said.

The hit to the U.S. economy has been swift and deep. Last week, 5.245 Americans filed first-time unemployment claims, the Labor Department reported Thursday. That brings the crisis total number to 22 million and almost wipes out all the job gains since the Great Recession. Retail sales fell a record 8.7%, the biggest drop since the government started tracking it in 1992, and manufacturing has dramatically declined.

U.S. & World

Meanwhile, 7.5 million small businesses are at risk of closing, a survey from Main Street America found.

All of this has led many people to become pessimistic about their future finances. Of those surveyed by NEFE, 41% said they will feel “very/somewhat worried” about their financial situation 12 months from now.

“Typically, Americans are very positive. They are very optimistic in their outlook” Hensley said. “Those numbers are something that we did not expect to see.”

Being proactive

Americans already are trying to take control of their money.

Of those polled, 75% said they have taken steps to adjust their personal finances during the outbreak. Over 2 in 5, or 42%, said they’ve cut monthly expenses, and 26% are delaying major financial decisions.

Meanwhile, 22% have upped contributions toward savings.

Only 17% have tapped into emergency savings and 6% have borrowed from their retirement account. While that may seem small, Hensley pointed out that it happened over the course of four weeks.

“When you think of how quickly that happened, and the millions of dollars that are needed to help families make ends meet ... [it] shows how financially fragile so many millions of Americans are.”

This story first appeared on CNBC.com

More from Invest in You:

How to pin down your coronavirus finances as tight as possible

‘This isn’t forever, but it is survival mode’ — how to handle your loss of income

7 ways small businesses can avoid bankruptcy amid the coronavirus outbreak

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.