- The value of this cryptocurrency continues to tick upward, rallying toward the end of 2020.

- Investors who have held their bitcoin for the long term and have a portfolio that’s overweight in cryptocurrency may consider donating it to charity.

- Virtual currencies are a complex asset, but some donor-advised funds are willing to accept these. In 2020, investors contributed close to $26 million in bitcoin to Fidelity Charitable’s donor-advised fund through Dec. 29.

Sitting on a growing bitcoin fortune? Consider giving away some of it to charity.

As 2020 draws to a close, the cryptocurrency has seen a massive surge in appreciation. The value of a single unit of bitcoin is now hovering around $28,000.

Though longtime holders of the virtual currency are rejoicing, they run the risk of winding up overweight in bitcoin. That is, the massive run-up in values could suddenly result in investors having more exposure toward bitcoin — and its risks — than they'd like.

Similarly, while cashing out of your holdings might seem attractive, it could come with a hefty capital gains tax bill on the appreciation.

More from Advisor Insight:

How financial advisors say to use your $600 stimulus check

Here's who's likely eligible for a second stimulus check

Covid relief bill adds PPP tax breaks the Treasury opposed

That's where charitable giving comes into play.

Money Report

"We believe in asset diversification, and because the price of bitcoin rose significantly, investors could be overallocated based on their targets for their portfolio," said Stefan Podvojsky, senior vice president of Fidelity Charitable.

"A donor advised fund provides a great outlet to remove that overweight and support the philanthropy that is important to the donor," he said.

Indeed, investors in bitcoin have been able to donate their holdings to donor-advised funds via Fidelity Charitable since 2015.

Benefactors have given close to $26 million in bitcoin to Fidelity Charitable's donor-advised funds year to date as of Dec. 29.

Donor-advised funds are accounts generous investors can fund with a variety of assets and use for making grants to their favorite charitable causes.

Nevertheless, giving away bitcoin and other crypto assets can come with a unique set of hurdles, including price volatility and additional tax reporting on the part of the investor.

Tax treatment under the IRS

Though you can convert cryptocurrency into dollars, the IRS regards it as property for income tax purposes.

This means you're subject to capital gains taxes if you decide to sell or exchange your virtual currency holdings.

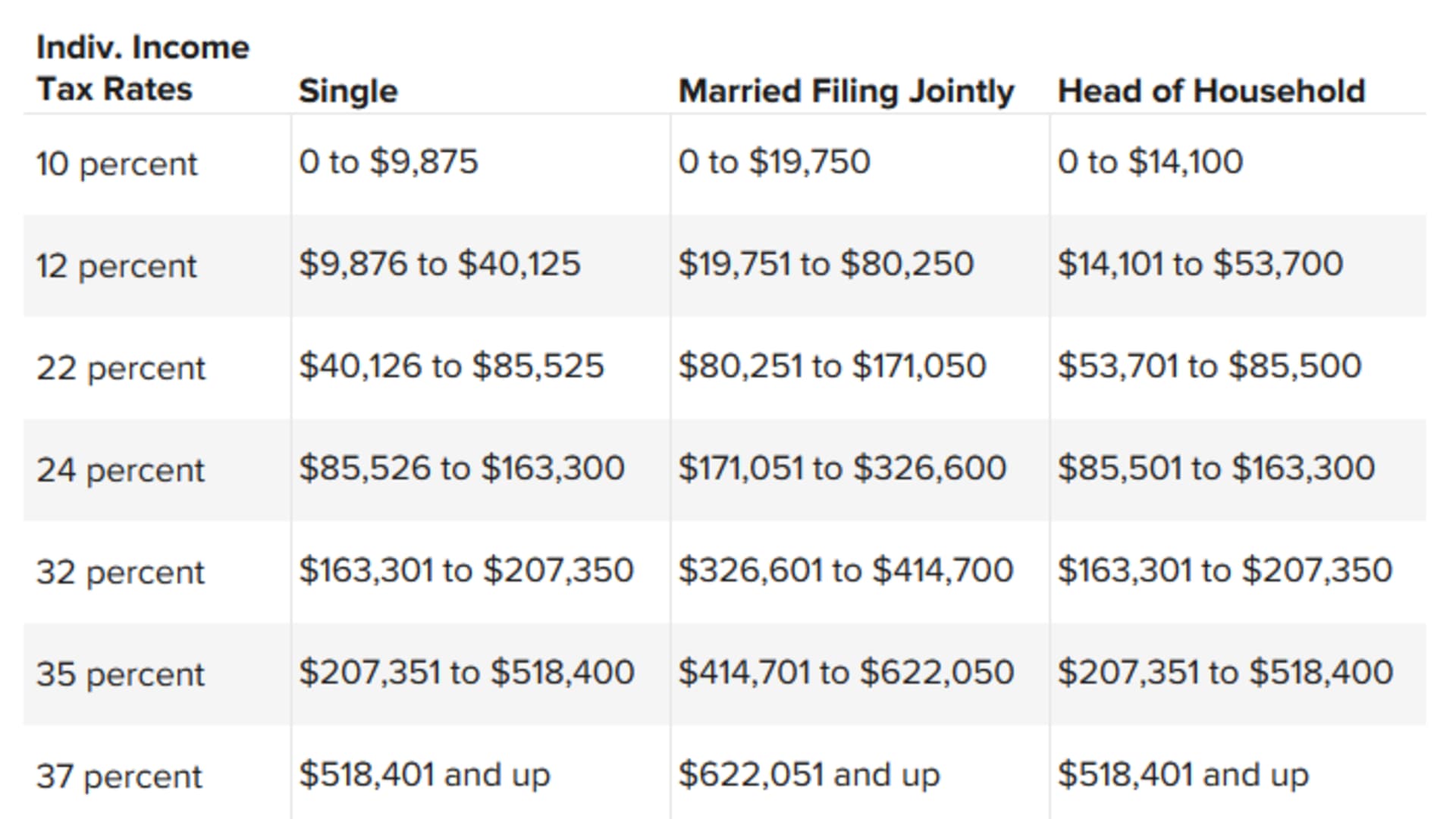

The magnitude of the tax hit will depend on how long you've held your bitcoin — if it's at least a year, you may qualify for the long-term capital gains rate of 0%, 15% or 20% — and your cost basis in the asset.

Investors who snapped up bitcoin when it was especially cheap — consider that one bitcoin was worth $7,220 Dec. 30, 2019 — may face the harshest tax consequences when they sell or exchange it.

That's because the tax would be based on the difference between their cost basis and today's market price.

Meanwhile, donating an asset you've held for at least a year will allow you to claim a tax deduction based on its fair market value.

"Donating it could be incredibly tax-conducive," said Bryan Clontz, founder and president of Charitable Solutions, a firm that specializes in receiving and liquidating noncash assets for charities.

"It's the holy grail of charitable planning: a low basis, highly appreciated asset," he said.

Another reason why donating crypto via a donor-advised fund might make sense: Your favorite charity may be skittish about accepting direct contributions of virtual currency due to data security issues.

"The big issue for charities is the volatility and the risk that if you set up your own wallet, wallets can be hacked," said Greg Sharkey, senior philanthropy advisor at The Nature Conservancy, a charity in Arlington, Virginia.

The organization teamed up with BitPay, a bitcoin payment service provider, to accept donations and convert them to cash.

"If the donor calls this morning and wants to make gifts and does it through BitPay, the money would be at the charity's account tomorrow," said Sharkey.

Fluctuation and tax complexity

What makes cryptocurrency so complex is the fact that not only are these assets subject to price volatility, but they also trade constantly.

Generally, the deduction a donor can claim is based on the price of the asset on the date they relinquish control to the donor-advised fund.

Fidelity Charitable only trades bitcoin during New York Stock Exchange market hours, or 9:30 a.m. to 4 p.m. Eastern, on weekdays, said Podvojsky.

"Depending on when during the day you might transfer the bitcoin to us, you would be subject to the price in the market and the liquidity we would be able to obtain at that point in time," he said.

Investors hoping to claim a tax deduction for their donation have extra legwork.

Because they're giving away a special asset, they must obtain a qualified appraisal from a third party and file Form 8283 with the IRS.

"Roughly $500 to $600 per appraisal would be the market for this space, and you'd have to have a larger donation to make it worth it," said Clontz. "There's a cost to the donor, and it's not just five minutes of work."

A team effort

Giving away those appreciated bitcoin holdings and collecting a tax write-off isn't just a one-person effort. Here are a few considerations:

- Gather your experts: Financial advisors have a bird's eye view of a client's holdings, but they'll likely need to link up with the client's accountant and a qualified appraiser to ensure the investor maximizes his tax deduction for the donation.

- Consider taking the donor-advised fund route: Volatility and data security are chief concerns for charities, and not all of them are equipped to take direct donations of crypto assets. A donor-advised fund can receive the gift, convert it and allow you to make grants to your favorite charities.

- Maintain solid records. The IRS has made no secret of its interest in crypto assets. The front page of the 2020 income tax return asks whether you've transacted in virtual currency over the year. Be sure to hold on to any acknowledgement letters you receive from charities, as well as your appraisal documents.

Correction: New York Stock Exchange market hours are 9:30 a.m. to 4 p.m. Eastern on weekdays. An earlier version misstated the times.