- A group of lawsuits accuse large landlords of price-fixing the market rate of rent in the United States

- A complaint filed by Washington D.C.'s Attorney General alleges 14 landlords in the district are sharing competitively sensitive data through RealPage, a real estate software provider

- RealPage recommends prices for roughly 4.5 million housing units in the United States

- RealPage told CNBC that its landlord customers are under no obligation to take their price suggestions

A group of renters in the U.S. say their landlords are using software to deliver inflated rent hikes.

"We've been told as tenants by employees of Equity that the software takes empathy out of the equation. So they can charge whatever the software tells them to charge," said Kevin Weller, a tenant at Portside Towers since 2021.

Tenants say the management started to increase prices substantially after giving renters concessions during the Covid-19 pandemic.

The 527-unit building is located roughly 20 minutes away from the World Trade Center, on the shoreline of Jersey City, New Jersey. A group of tenants at the tower is involved in a sprawling class-action lawsuit against RealPage and 34 co-defendant landlords. The U.S. Department of Justice filed a statement of interest in the case in December 2023, arguing that the complaints adequately allege violations of the Sherman Antitrust Act.

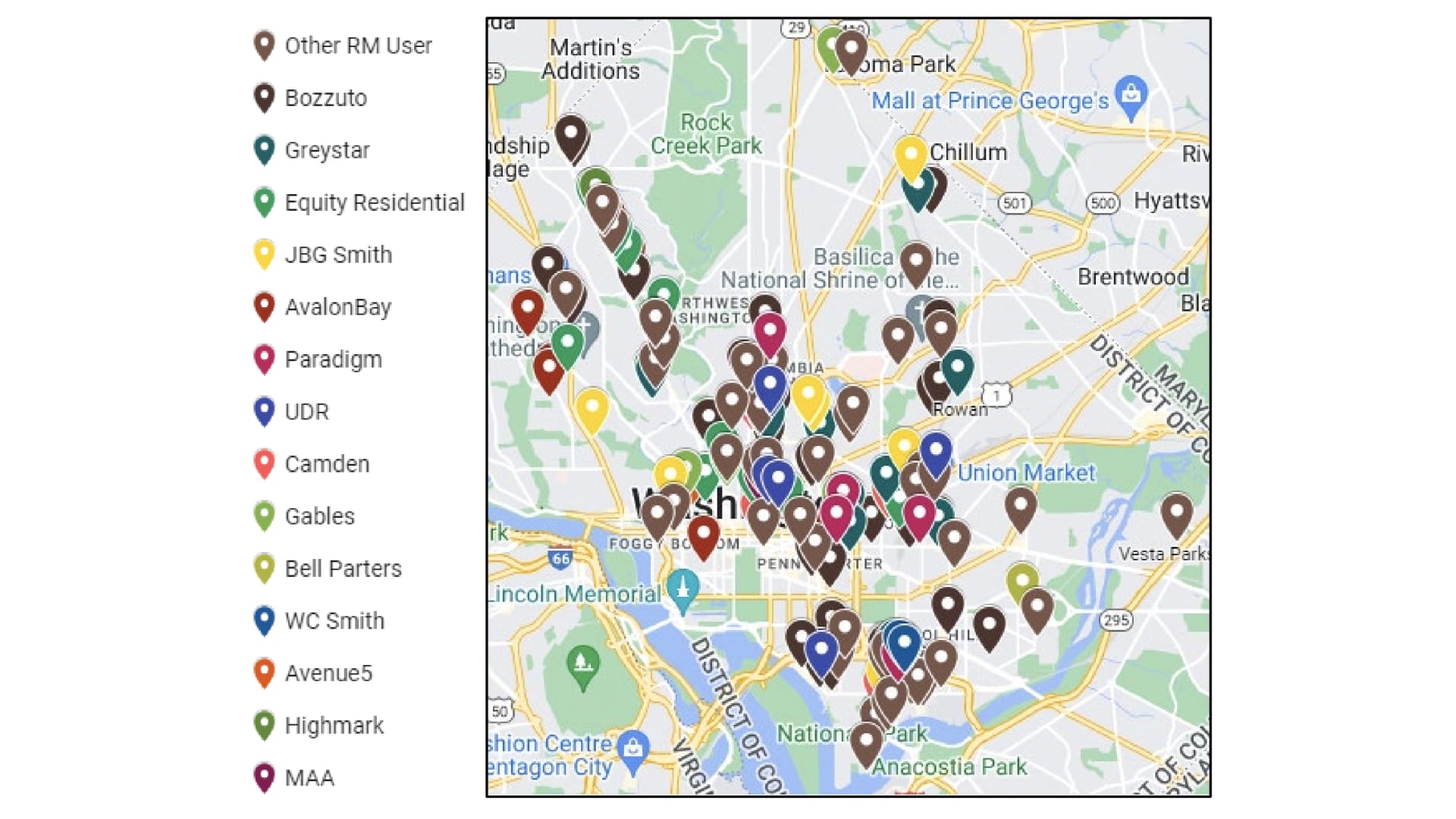

In November 2023, the attorney general of Washington, D.C., filed a similar but more narrow complaint against RealPage and 14 landlords that collectively manage more than 50,000 apartment units in the District.

"Effectively, RealPage is facilitating a housing cartel," said Attorney General of the District of Columbia Brian Schwalb in an interview with CNBC. His office filed the complaint on antitrust grounds. They allege that landlords share competitively sensitive data through RealPage, which then sets artificially high rents on a key slice of the local rental market.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

"Rather than making independent decisions on what the market here in D.C. calls for in terms of filling vacant units, landlords are compelled, under the terms of their agreement with RealPage, to charge what RealPage tells them," said Schwalb.

Money Report

RealPage says its revenue management products use anonymized, aggregated data to deliver pricing recommendations on roughly 4.5 million housing units in the U.S. The company says its tools can increase landlord revenues between 2% and 7%.

"Just turning the system on will outperform your manual analyst. There's almost no way it can't," said Jeffrey Roper, a former RealPage employee and inventor of YieldStar.

YieldStar is one of three key revenue management tools offered by RealPage. The software balances prices, occupancy and lease lengths to help property managers optimize their portfolio's yield. The company feeds data from its models into a newer tool dubbed "AIRM" that considers the effect of credit, marketing and leasing effectiveness.

RealPage told CNBC that its landlord customers are under no obligation to take their price suggestions. The company also said it charges a fixed fee on each apartment unit managed with its software.

RealPage was acquired by Miami-based private equity firm Thoma Bravo for $10.2 billion in 2021. In court filings, Thoma Bravo has claimed that it is not liable for the alleged acts of its subsidiary outlined by plaintiffs in the class-action complaints.

Renters told CNBC they discovered how revenue management software is used in real estate after reading a 2022 ProPublica investigation. Equity Residential investor materials show that the company started to experiment with Lease Rent Options between 2005 and 2008. RealPage acquired the product in 2017.

"How could we possibly know?" said Harry Gural, a tenant in an Equity Residential property located in the Van Ness neighborhood of Washington, D.C. Gural says he has been involved in legal matters against his landlord's pricing practices for more than seven years.

Affiliates of Equity Residential are contesting a separate decision made by a local housing authority in Jersey City regarding prices set on the Portside Towers property. The company has filed a lawsuit in federal court challenging the decision, stating that the decision could result in millions of dollars in refunds for tenants.

Equity Residential and other defendant landlords declined to comment on ongoing RealPage litigation.

Redfin reports that asking rents in the U.S. ticked down to $1,964 a month in December 2023, a decline from recent highs. Prices are coming down in markets such as Atlanta and Austin, Texas, where home construction is high. But analysts believe low rates of homebuilding on the U.S. East Coast could give well-located landlords more pricing power.

"Guys like us that own 80,000 well-located apartments, we're still in a pretty good spot," said Equity Residential CEO Mark Parrell in a June 2023 interview with CNBC.

Watch the video above to learn about the rising tide of lawsuits against U.S. corporate landlords.

CORRECTION: A previous version of this article misstated when Equity Residential purchased Portside Towers.