- A federal indictment was unsealed alleging widespread fraud by FTX co-founder Sam Bankman-Fried.

- That document was filed after the fallen crypto exchange operator was arrested in the Bahamas in connection with the charges.

- The indictment charges Bankman-Fried with multiple counts of securities, wire fraud, conspiracy, money laundering and violating campaign finance regulations.

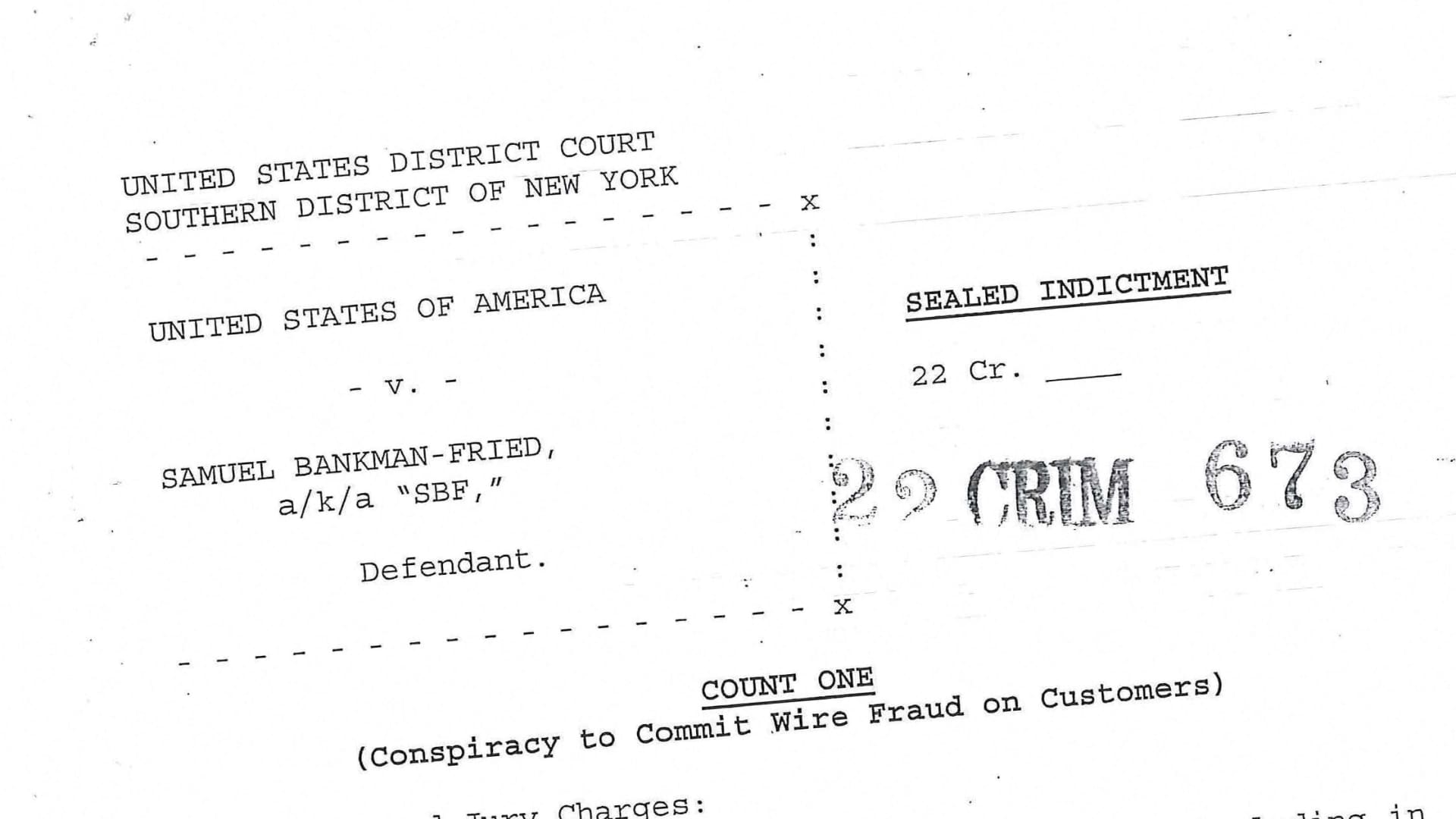

A federal indictment was unsealed Tuesday alleging widespread fraud by FTX co-founder Sam Bankman-Fried, a day after the fallen crypto exchange operator was arrested in the Bahamas in connection with the charges.

The indictment in U.S. District Court in Manhattan charges Bankman-Fried with eight criminal counts: conspiracy to commit wire fraud and securities fraud, individual charges of securities fraud and wire fraud, money laundering, and conspiracy to avoid campaign finance regulations.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

Follow CNBC's live blog covering Tuesday's hearing on the collapse of cryptocurrency exchange FTX before the House Financial Services Committee.

Prosecutors allege in the indictment that the former billionaire was engaging in criminal activity that began as far back as 2019 and continued through last month.

Bankman-Fried deliberately and knowingly "agreed with others to defraud customers of FTX.com by misappropriating those customers' deposits and using those deposits to pay expenses and debts of Alameda Research," the indictment alleges.

Money Report

It also accuses Bankman-Fried of conspiring with others to defraud FTX's lenders "by providing false and misleading information to those lenders regarding Alameda Research's financial condition."

Prosecutors also allege he conspired with others to make illegal donations to political candidates, using the names of other persons to mask and augment political giving.

His attorney Mark Cohen, in a statement, said, "Mr. Bankman-Fried is reviewing the charges with his legal team and considering all of his legal options."

Howard Fischer, a former Securities and Exchange Commission lawyer, told CNBC, "Given the speed of the government complaints and the indictment, it seems likely that former FTX employees (most likely those in senior positions) were cooperating with the authorities, most likely in exchange for leniency."

"With a large case like this, there is often a rush to be the first one in the prosecutor's door, because the value of cooperation diminishes rapidly if all you can offer is a duplicate of what the authorities already have," said Fischer, a partner with the law firm Moses & Singer.

Fischer, referring to former Alameda CEO Caroline Ellison, said, "While it is not known yet if that is the case, or who might be cooperating at this point, I would not be surprised if Ms. Ellison was one of the first person's seeking to help the prosecution."

He noted that Ellison's own lawyer is the former co-head of SEC's Division of Enforcement, and she knows how the system works and how to work it to her client's advantage."

Ellison's attorney was not immediately available to comment.

Bankman-Fried's arrest took the public and lawmakers by surprise. The accelerated timeline suggests prosecutors have a high level of confidence in securing a conviction, a legal expert told CNBC.