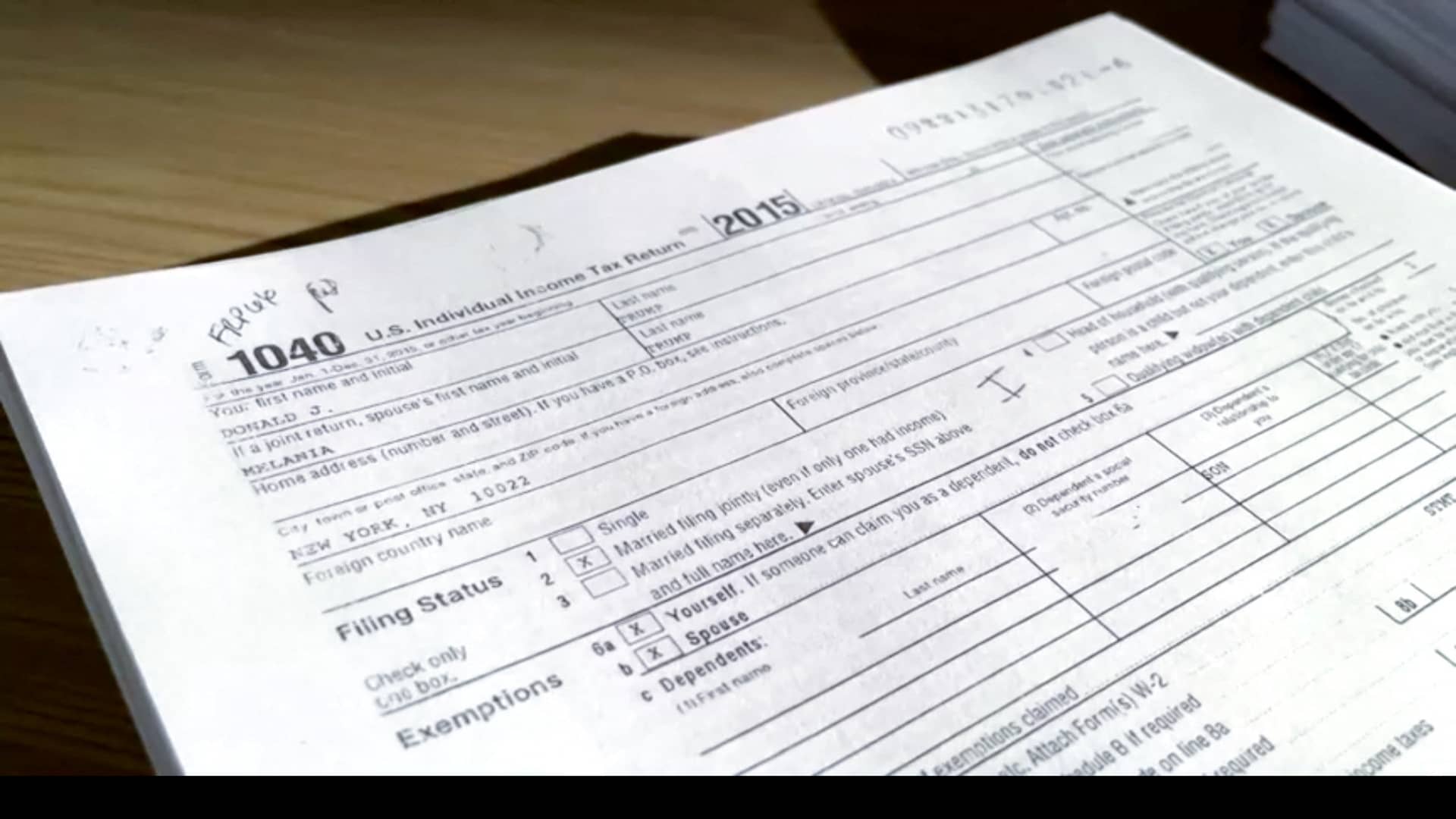

- The House Ways and Means Committee released six years of former President Donald Trump's tax returns.

- The panel released the documents, which cover the years 2015 through 2020, after a lengthy fight over making them public.

- The returns offer the most complete picture yet of the ex-president's finances while he was in the White House.

The House Ways and Means Committee released six years of former President Donald Trump's tax returns on Friday, offering the most detailed account yet of his finances while in the White House.

The panel voted last week to make the returns public with redactions of sensitive information, after a lengthy legal battle. The Ways and Means Committee last month obtained Trump's federal income tax returns for the years 2015 to 2020, along with tax records for some of his business entities. The panel had sought the records since 2019, when Trump was president, and he tried to block their release in court.

The individual and business tax returns released by the committee can be found here.

The panel released a report earlier this month summarizing the ex-president's returns. The summary prepared by the Joint Committee on Taxation showed Trump declared negative income in 2015, 2016, 2017 and 2020. He paid a total of $1,500 in income taxes for the years 2016 and 2017.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

Trump's financial records — some of which came to light through New York Times reporting in recent years — show the former president who ran for office in part on his business acumen routinely declared large losses and paid little or no taxes in multiple years. The tax returns suggest that many of Trump's businesses saw significant losses from the year he launched his first presidential bid through his first term as commander in chief. Trump has repeatedly said he was smart to use deductions or losses to minimize his tax burden.

The financial records show:

- Trump and his wife Melania declared negative income of $31.7 million, and taxable income of $0, on their 2015 return. They paid $641,931 in federal income taxes.

- On their 2016 return, the Trumps declared negative income of $32.2 million, and again recorded $0 of taxable income. They paid $750 in taxes.

- Trump and his wife declared $12.8 million in negative income in the 2017 return, with $0 in taxable income. They again paid $750 in taxes.

- The 2018 return showed a rosier picture for the Trumps' finances: they declared $24.4 million in total income, and $22.9 million in taxable income. They paid $999,466 in federal income taxes.

- Trump and his wife declared $4.44 million in total income, along with $2.97 million in taxable income, on their 2019 return. They paid $133,445 in taxes.

- The 2020 return declared negative income of $4.69 million and no taxable income. They paid no tax and claimed a refund of $5.47 million.

- The returns show major losses for many Trump properties during the six years. For instance, a 2015 tax return for "DJT [Donald J. Trump] Holdings LLC" showed a $12 million loss for Trump Turnberry Scotland. The Turnberry golf course lost up to millions of dollars each year until the final year of Trump's presidency, returns show. Trump paid $63 million in his 2014 purchase of the property, according to an Independent report at the time.

- Trump's Washington, D.C. hotel in the Old Post Office building lost millions of dollars each year during his first term in office, tax returns show. The hotel was a hub of activity for Trump allies and others who hoped to curry favor with the former president, and GOP-aligned political committees spent tens of millions of dollars there. Trump's company completed a deal to buy the building in 2013, arranging for a 60-year lease agreement and putting about $200 million toward developing it into a hotel. NBC News reports the property lost more than $70 million while Trump was in office. The Trump Organization announced earlier this year that it had closed a $375 million sale of the Old Post Office property.

- Trump reported foreign bank accounts in the United Kingdom, Ireland and China on his returns from 2015 through 2017. The 2018 through 2020 returns list only an account in the U.K.

The Democratic-led panel released the returns only days before Republicans are set to take control of the House. The vast majority of House GOP lawmakers have defended Trump, who has launched another bid for the Republican presidential nomination in 2024.

Money Report

In a statement by the Trump campaign Friday, the former president criticized the House panel for releasing the returns and the Supreme Court for allowing the committee to obtain them.

Trump argued the documents "once again show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises."

The former president broke with decades of precedent by refusing to release his tax returns as a candidate in the 2016 election. The 2024 campaign will be Trump's third bid for president — but the first where the public will have a clearer picture of his finances and business record.

The Democratic-led Ways and Means Committee said it wanted Trump's tax returns as part of a probe of how the IRS audits presidential returns. The agency is required to audit the sitting president's returns every year.

House Republicans have signaled their new majority will take a softer tone toward Trump and push to investigate the Biden administration.

In a statement Friday, Ways and Means Committee ranking member Rep. Kevin Brady, R-Texas, contended Democrats unleashed "a dangerous new political weapon" by releasing the returns.

— CNBC's Dan Mangan contributed to this report.