- The developers of the Arte complex say that accepting crypto attracts a younger new-money buyer, and can be smoother than even an all-cash deal.

- Drawbacks include currency fluctuations and the inability to source the buyer's funds.

- There are also tax implications. "Every time you spend crypto to buy a cup of coffee or a condo in this case, that triggers capital gains taxes," said Shehan Chandrasekera, a CPA and head of tax strategy at CoinTracker, a crypto tax software company.

Two luxury condos are up for sale in one of Florida's most exclusive oceanfront properties for a combined price of $31 million – and the developers are accepting payment in bitcoin.

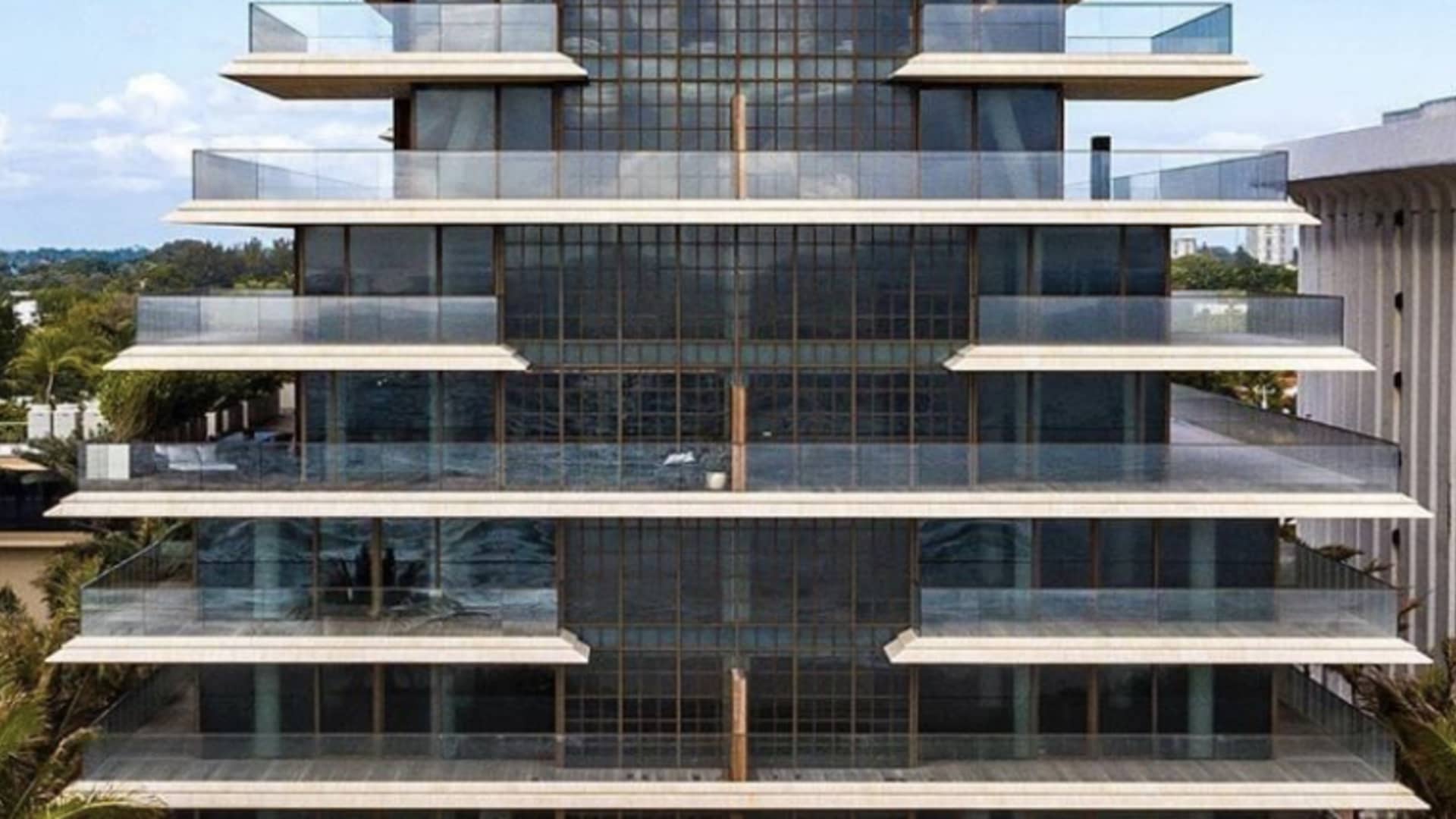

The 16-residence, 12-story building in the town of Surfside near Miami is called Arte, and prices start at more than $10 million apiece. Developers Alex Sapir and Giovanni Fasciano say interested buyers are welcome to make offers in either bitcoin or ethereum. Earlier this year, they sold a penthouse in the building for a record-breaking $22.5 million in crypto.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

Prospective buyers have their pick of two apartments. A 6,982-square-foot unit is up for sale for $18.95 million and a second property, about half that size, is $11.9 million. Based on its most recent price, that would come to 560 bitcoin. Both boast wraparound terraces with oceanfront views, sizable walk-in closets, direct elevator entry with fingerprint recognition tech and floor-to-ceiling glass walls.

Building amenities are similarly decadent.

There are indoor and outdoor swimming pools, as well as a full-size rooftop tennis court. Arte residents can also get lessons from celebrity tennis coach James Bollettieri. Other perks include a gym, yoga studio, sauna, steam room, children's playroom, catering kitchen, temperature-controlled parking spaces and a fleet of white-glove butlers.

Real estate boom meets crypto boom

Money Report

Covid-driven work and travel restrictions have been good for the real estate business. Home prices have climbed at a record pace amid a nationwide housing boom.

The surge coincides with the recent run-up in bitcoin and other cyrptocurrency prices, and the two trends are converging in Miami, which is trying to position itself as the crypto capital of the U.S.

Miami real estate mogul Marc Roberts accepts crypto deposits for his condos, claims to have sold a penthouse for $22 million in crypto and co-owns E11even, which allows patrons to deal in bitcoin.

There are also sites which have made it easier to locate properties available for purchase with crypto.

"We were overwhelmed by the amount of calls we received from qualified buyers just after announcing our ability to facilitate cryptocurrency transactions for the condominiums at Arte," Sapir said. "Real-world crypto transactions haven't made their way fully into the mainstream yet, so it's clear that top holders around the world pay attention when new opportunities to transact open up."

The real estate pair told CNBC they believe they are "approaching a new audience which is looking to lock in their profits in coin by investing in a stable asset like real estate."

The Arte team said transacting in crypto was smooth and even faster than a traditional all-cash deal. The developers received an offer for the penthouse days after announcing they would accept crypto, and the sale closed two weeks after that.

The property developers won't reveal the identity of the owner, nor which form of cryptocurrency was accepted for the property. However, they did tell CNBC how they go about conducting a real estate sale in virtual tokens.

The deal is structured between two wallets, and the funds are converted into U.S. dollars prior to the transfer of the deed. At this point, the conventional mechanism of any real estate transaction goes into play, such as funding in escrow and disbursement of payments by an escrow agent.

But it's not all smooth sailing.

Fluctuations in the price of cryptocurrency can create challenges with pricing and settlement terms. In addition, the built-in anonymity and privacy behind crypto transactions can make it hard to trace the source of funds, which is required for compliance checks. One possible solution is to shift the conversion risk to the buyer and then to perform independent compliance checks.

Capital gains hit

Just because there are more opportunities to buy a house in crypto doesn't mean that you should, say tax experts.

The IRS treats virtual currencies like bitcoin as property, meaning that they are taxed in a manner similar to stocks or real property.

"Every time you spend crypto to buy a cup of coffee, or a condo in this case, that triggers capital gains taxes," explained Shehan Chandrasekera, a CPA and head of tax strategy at CoinTracker, a crypto tax software company.

At the time of a transaction, if the buyer's crypto holdings have appreciated in value since the tokens were first purchased, that would subject the sale to either long-term or short-term capital gains taxes.

The better option, according to Chandrasekera, would be to leverage one's crypto holdings in a real estate deal.

"If your net worth is tied to cryptocurrency, I think it makes more sense to get a loan against your crypto and spend the cash to buy a property," he said. "This is because getting a loan against your crypto is not a taxable event. You get liquidity without triggering a taxable event."

It is also possible to take out a mortgage against a nonfungible token.

But in either case, the buyer will still have to pay off the loan over a period of time. Chandrasekera says rates might be higher than the traditional mortgage rates, but "this is great for people who don't have a good credit history or want to own a place without going through traditional institutions."