- The PGA Tour is defending its proposed deal with LIV Golf ahead of Tuesday's Senate hearing.

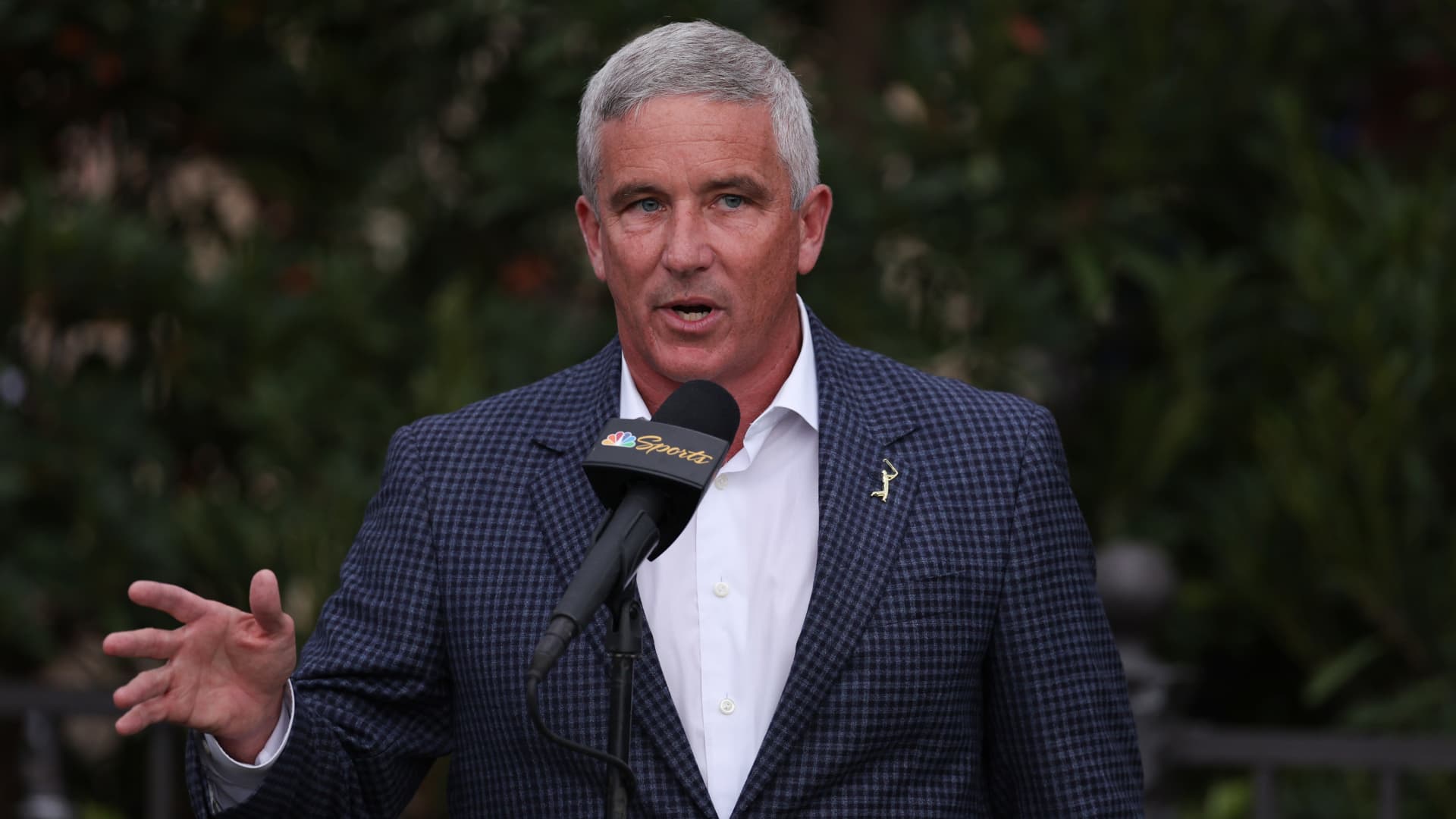

- "That future for the PGA Tour is significantly brighter thanks to this agreement," Chief Operating Officer Ron Price said in an op-ed Monday.

- Price and another PGA Tour official will testify Tuesday during a hearing called by Sens. Richard Blumenthal and Ron Johnson, chairman and ranking member of the Permanent Subcommittee on Investigations, respectively, regarding the merger between the PGA Tour and Public Investment Fund's LIV Golf.

- The hearing comes shortly after former AT&T chief Randall Stephenson resigned from the PGA Tour's policy board, citing "serious concerns."

The PGA Tour has begun its public defense of its deal with Saudi-backed LIV Golf ahead of a key Senate hearing slated for this week.

The tour's chief operating officer, Ron Price, who is set to testify Tuesday, released an op-ed in The Athletic on Monday defending the deal and explaining why it was the best outcome for the future of golf. He also argued the agreement should not be considered a merger.

"Given the well-chronicled legal disputes that have existed between the PGA Tour and PIF, we understand the fair and valid questions raised by PGA Tour members, Tour partners, media, fans and now Congress," Price said in the op-ed.

The piece comes days after a shake-up at the PGA Tour's policy board that added another wrinkle to what could be a rocky road toward approval of the deal.

Former AT&T CEO Randall Stephenson on Saturday resigned from the PGA Tour's policy board, which he served on since 2012. Stephenson stepped down as lawmakers appeared likely to start a broad probe into the merger between the PGA Tour and LIV, beginning with Tuesday's Senate hearing.

Get Tri-state area news delivered to your inbox.> Sign up for NBC New York's News Headlines newsletter.

Sen. Richard Blumenthal and Sen. Ron Johnson, the chairman and ranking member of the Senate Homeland Security Committee's Permanent Subcommittee on Investigations, respectively, called the meeting on Tuesday. The senators requested officials from the tour and Saudi Public Investment Fund to appear before the panel.

While the senators requested testimony from PGA Tour Commissioner Jay Monahan, Price and policy board independent director Jimmy Dunne will instead appear, the tour said in a statement last week. Monahan has been on a leave of absence due to an unspecified medical situation, but recently announced he will return to his role on July 17.

"We look forward to appearing before the Senate Subcommittee to answer their questions about the framework agreement that keeps the PGA TOUR as the leader of professional golf's future and benefits our players, our fans, and our sport," a PGA Tour representative said in a recent statement.

Money Report

The tour did not comment beyond Price's op-ed on Monday.

The senators had said in an earlier letter that the subcommittee would examine the proposed deal and the Saudi fund's "investment in golf in the United States, the risks associated with a foreign government's investment in American cultural institutions, and the implications of this planned agreement on professional golf in the United States going forward."

It is unknown whether representatives for the Saudi Arabia Public Investment Fund will testify. Representatives for PIF have not responded to multiple requests for comment.

Defending the deal

Last month, the PGA Tour and PIF's LIV Golf, as well as Europe's DP World Tour, agreed to merge. While specific terms and the valuation of the deal have not been announced, an early framework of the proposed transaction shows it would create a for-profit subsidiary of the PGA Tour, and the new entity would manage commercial assets for all the tours. The PGA Tour would manage competitions.

The proposed deal came as a shock to the sports world — including the tour's own players — following months of tensions between the PGA Tour and LIV Golf, which led to both entities filing antitrust claims against each other. All litigation between the two has been squashed as part of the proposed deal.

Price, in Monday's op-ed, acknowledged the deal was a surprise after two years of "unprecedented conflict."

Negotiations are still ongoing and the framework ends litigation between the two entities. Price contended that due to the confidential nature of the deal, "much of the initial reaction has been negative, colored by misinformation or misunderstanding."

"That's something we take full ownership of and deeply regret. Moving forward, we firmly believe that the more the facts are discussed and understood, the further our constituents can support a potential definitive agreement — if reached — and look forward to the positive and lasting impact on all levels of our game," Price said in Monday's op-ed.

The two entities had been embroiled in antitrust lawsuits since last year. LIV had sued the tour, alleging anti-competitive practices for banning its players, while the tour countersued, claiming LIV was stifling competition.

Price defended the framework agreement so far as a favorable outcome not only for the tour, but also for professional golf as a whole. He said the agreement "provides clear, explicit and permanent safeguards that ensure the PGA Tour will lead the decisions that shape our future, and that we'll have control over our operations, strategy and continuity of our mission."

He added if the sides reach an agreement, it will allow further investment in players, events, venues, communities and technology. The PIF has said it would invest billions of dollars into the new entity.

Price also contended the deal "is not a merger." He wrote that the tour would remain intact, and that the newly formed subsidiary will include PIF as a noncontrolling, minority investor, as it is in "many other American businesses." The majority of the board that leads the PGA Tour Enterprises will be appointed by the tour and run by Monahan.

Following the announcement, top player Rory McIlroy — who repeatedly slammed LIV Golf during the years of acrimony — expressed agitation about the proposed deal being referred to as a merger.

LIV controversy

Controversy has surrounded LIV since its inception in 2022. The PIF is not publicly held and is a sovereign wealth fund controlled by bin Salman. Critics have accused the fund of "sportswashing," or using LIV and other sports investments to improve the image of the oil-rich nation and distract from the kingdom's history of human rights violations.

Stephenson in his resignation letter on Saturday to fellow board members pointed to one of those alleged violations.

The tour notified its members on Sunday evening of Stephenson's departure from the policy board, according to a memo viewed by CNBC. It noted there "is no specific time frame in which a successor independent director has to be appointed." The four remaining independent directors, in consultation with the board's five player directors and PGA director, will work together to fill the position.

In the memo, he wrote that he had "serious concerns" about the proposed deal and whether he could objectively evaluate or support it due to the U.S. intelligence report assessing Saudi Crown Prince Mohammed bin Salman ordered the killing of journalist Jamal Khashoggi in 2018. The memo was earlier reported by the Washington Post.

Stephenson's concerns about accepting Saudi investment are similar to those voiced by others in the tour, along with politicians. Stephenson didn't respond to requests for comment.

A U.S. Intelligence report from 2021 showed that the Saudi crown prince had approved an operation to capture or kill the journalist Khashoggi in 2018. It cited bin Salman's control of decision-making in Saudi Arabia, as well as the involvement of a key advisor and members of the prince's protective detail in the operation that killed Khashoggi, a critic of the royal family.

Lawmakers have raised doubts about the merger since the golf tours announced it. Top Senate Democrats have called out antitrust concerns and have pressed for an inquiry into the merger.

"Fans, the players, and concerned citizens have many questions about the planned agreement between the PGA Tour and LIV Golf," Johnson said in a release last month.

While the Subcommittee on Investigations has broad jurisdiction to probe matters including corporate abuses, committee hearings are relatively rare and typically mark the early phase of a longer investigation. The hearing on the merger is the committee's second this year.

Before scheduling the meeting, Blumenthal had announced his intention to investigate the deal in light of Saudi Arabia's human rights abuses.

When the deal was announced, Monahan acknowledged the shock and anger it triggered among players.

LIV Golf events were met with protests, particularly from the family members of those who perished in the Sept. 11, 2001, terrorist attacks. Fifteen of the 19 hijackers on that day were from Saudi Arabia, and Osama bin Laden, the mastermind behind the attacks, was born in the country. U.S. officials concluded that Saudi nationals helped to fund the terrorist group al-Qaeda, although the investigations didn't find that the Saudi officials were complicit in the attacks.

Members of the group 9/11 Families United slammed the deal. They have also called out Monahan for remarks in an interview last summer, when he said he discussed the 9/11 connections with PGA Tour players and suggested the organization stood on a higher moral ground than LIV.

"I think you'd have to be living under a rock not to know there are significant implications," Monahan said during the interview with CBS Sports. "I would ask any player who has left or any player who would consider leaving, 'Have you ever had to apologize for being a member of the PGA tour?'"