- Shoppers have more payment options at checkout than ever before.

- The payment method you choose can go a long way toward helping you stick to a budget, save money and stay out of debt.

- The rising cost of living is straining household budgets just as the peak shopping season kicks into high gear.

What you buy this holiday season is just as important as how you buy it.

In fact, the payment method you choose at checkout can go a long way toward helping you stick to a budget, save money and stay out of debt.

"The credit card is the gold standard in terms of rewards and buyers protections, but the interest rates are a huge drawback," said Ted Rossman, senior industry analyst at Bankrate and Creditcards.com. "The biggest thing I would worry about is debt."

More from Personal Finance:

Consumers are cutting back on gift buying

Free returns may soon be a thing of the past

Affluent shoppers embrace secondhand shopping

The rising cost of living is straining household budgets just as the peak shopping season kicks into high gear. That can make paying with credit more appealing, but there may be other options that fit your needs even better.

Money Report

"It comes back to knowing yourself," Rossman said.

From credit cards to cash, installment buying and payment apps, here's a breakdown of some of the best ways to pay this holiday.

1. Credit cards

Most Americans rely on credit thanks to convenience, rewards and buyer-protection programs. When it comes to holiday shopping, cashback or rewards cards offer an added bonus of 2% or more in certain categories.

“If you have multiple cards in your wallet, use the one that will give you the most value in return on the purchases you’re making,” said Elly Szymanski, assistant vice president of credit card products at Navy Federal Credit Union. "For instance, a card that allows you to redeem rewards on your everyday spend for cash back, gift cards or merchandise may be your best bet for holiday shopping." (CNBC’s Select has a full roundup of the best cards for holiday shopping.)

If you’ve already banked rewards, this is a good time to cash them in, Szymanski added. “With many households looking to spend less this holiday season, one of the best ways to save is take advantage of the points and rewards you’ve accumulated over the course of the year by using your credit card.”

However, credit card interest rates are at record highs and only heading higher as the Federal Reserve hikes rates in an effort to curb record high inflation. With annual percentage rates close to 20% or even 30% on some retail cards, racking up any credit card debt will come at a high cost. (In debt? Take these steps to help trim high-interest account balances.)

"Credit cards should only be used if you can pay them in full each month," cautioned Chelsie Moore, director of wealth management solutions at Country Financial. "Utilize them as if the cash is coming directly out of your checking account.

"So, if you see yourself spend beyond your budget, you may need to switch to utilizing cash or a debit card."

2. Debit cards or cash

Fewer consumers use cash at all these days, but there may be some advantages when it comes to gift buying, according to Rossman, including being able to make a purchase for a loved one under the radar.

Also, merchants increasingly are promoting cash transactions to avoid credit card transaction fees, so, in some cases, paying with cash can shave roughly 3% off the purchase price.

"There's been a backlash about credit card processing fees," Rossman said. "One of the levers merchants pull is offering a cash discount."

Rossman advises shoppers to do the math: Saving on the processing fee could exceed what your credit card offers in cashback rewards. "Especially if it's a big-ticket item, that could really add up," he said.

In addition to the potential savings, relying on cash or a debit card can help you stick to a budget, other experts say. Stashing cash in an envelope for holiday gift buying (or any other spending category) is an age-old hack to stay disciplined in your spending.

Just recently, the envelope-budgeting method made a comeback on TikTok in the form of "cash stuffing."

Of course, you don't need an actual envelope. "Some find it helpful to have multiple checking accounts with smaller amounts of cash, then you can have debit cards dedicated for specific purposes," Moore said.

3. Buy now, pay later

This season, most consumers will also have the option to buy now, pay later when shopping online at retailers like Target, Walmart and Amazon, and many providers have browser extensions, as well, which you can download and apply to any online purchase. Then there are the apps, which let you use installment payments when buying things in person, too — just like you would use Apple Pay.

The ability to spread out a purchase with no interest offers another distinct advantage over credit cards. However, studies have also shown that installment buying could encourage consumers to spend more than they can afford. Plus, some users say making a return — which is key when it comes to holiday gifts — could be trickier using this payment method.

For now, BNPL loans are not subject to the same regulations that apply to credit or debit cards and there are fewer purchase protections, including the ability to dispute a charge if you bought a good or service that wasn't delivered as promised.

4. Digital payments

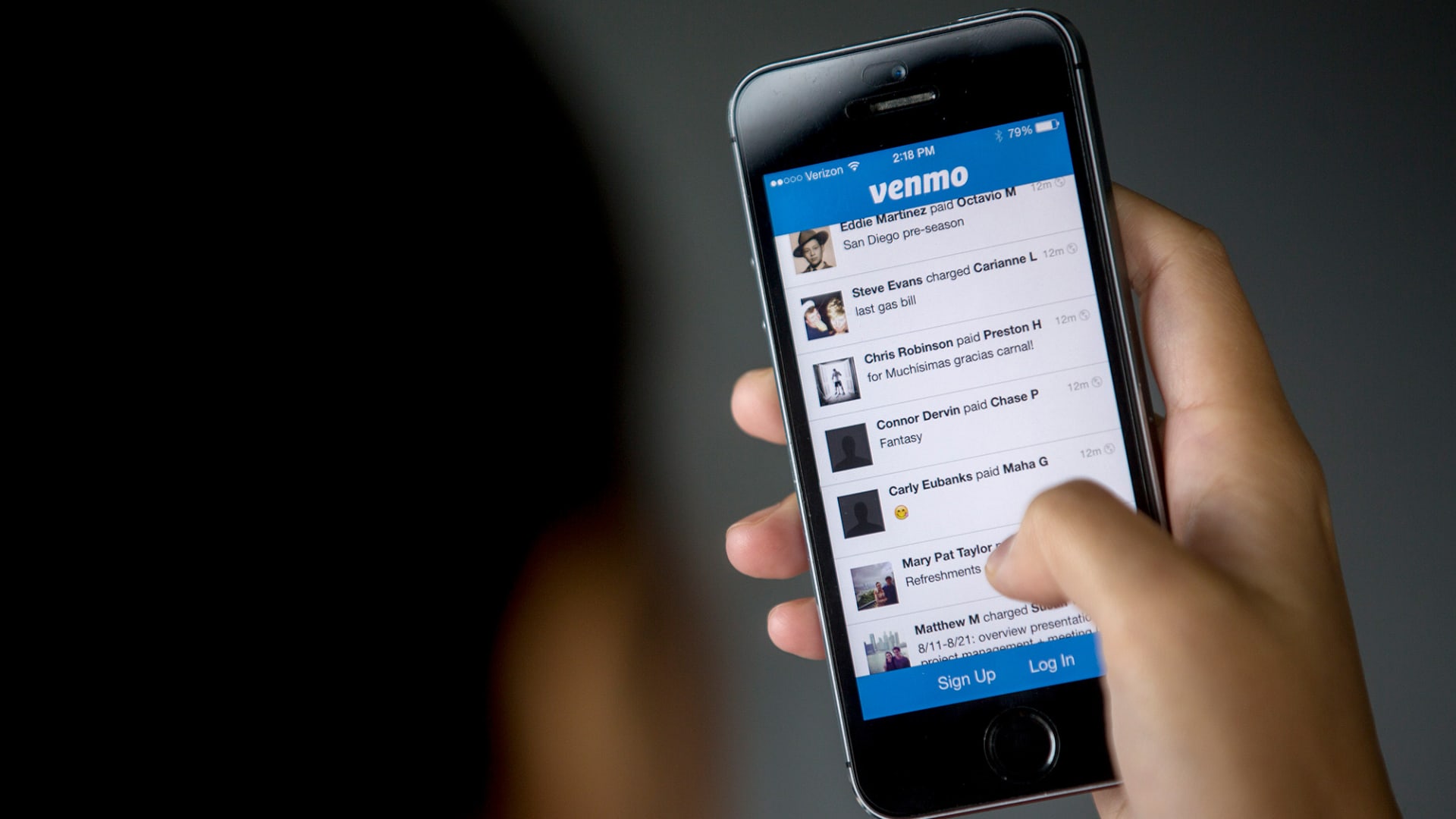

Digital-payment options are now nearly as ubiquitous as cash or credit cards — even Amazon now offers Venmo.

Apps like Apple Pay, Venmo and Zelle work like cash but also are both generally free and more secure than even credit cards.

But like BNPL, peer-to-peer payments, known as P2P, have varying degrees of consumer protections, which could cause an issue when it comes to getting a refund.

Trying to get money back into your personal account after it's been transferred to someone else may require more work compared to requesting a refund with a credit card company, which often reverses charges almost immediately and fights on your behalf.

"It's kind of like getting the toothpaste back in the tube," Rossman said.