- India's coal imports from Russia jumped in March to highs not seen in more than two years, according to data from commodity intelligence firm Kpler.

- The European Commission last week proposed banning Russian coal as part of a new round of sanctions against Moscow for its invasion of Ukraine.

- "Markets suspect that India and China may boost coal imports from Russia, offsetting some of the impact of a formalised EU ban on Russian coal imports," Vivek Dhar from the Commonwealth Bank of Australia said in a note.

- "The White House has fired two 'warning shots' to date, pressuring India to be on the 'right side of history' and avoid aligning with Russia. There likely won't be a third if this persists," said Samir N. Kapadia, head of trade at government relations consulting firm Vogel Group.

India's hunger for coal is growing. Even as the world shuns Russian goods, the Asian giant is setting its sights on Russian coal – after already buying up its discounted oil.

The European Commission last week proposed banning Russian coal as part of a new round of sanctions against Moscow for its invasion of Ukraine.

On the other hand, India's coal imports from Russia jumped in March to highs not seen in more than two years, according to data from commodity intelligence firm Kpler.

Coal imports from Russia were at 1.04 million tonnes, the highest level since January 2020, Kpler's Matthew Boyle, lead dry bulk analyst, told CNBC in an email. As much as two-thirds of March's volume came from Russia's Far East ports, likely after the war began in late February.

"Markets suspect that India and China may boost coal imports from Russia, offsetting some of the impact of a formalised EU ban on Russian coal imports," Vivek Dhar, director of mining and energy commodities research at the Commonwealth Bank of Australia, said in a note last week.

Get Tri-state area news delivered to your inbox. Sign up for NBC New York's News Headlines newsletter.

Money Report

Last week, India said it planned to double imports of Russian coking coal, used to make steel.

"The EU ban on Russian coal imports comes at a time when the international coal market is already very tight, with correspondingly high prices," said Rystad Energy in a note. "A surge in coal demand in Asia, as countries try to minimize imports of expensive natural gas, has sent coal prices soaring in the past year."

The main benchmark for coal imported into Europe — the API 2 — saw May prices surge to $300 per tonne last Tuesday, compared to $70 per tonne a year ago, according to Rystad Energy.

India's coal crunch will likely benefit from a mega trade deal it signed with Australia on April 2, as the commodity qualifies for the lifting of tariffs.

Tariffs are set to be removed on more than 85% of Australian goods exported to India. That, however, will have its limitations as Australia won't have sufficient coal to meet India's growing needs, said analysts.

Coal accounts for around 70% of India's electricity generation, according to the International Energy Agency's 2021 India energy outlook report. The country is the world's second-largest consumer and importer of coal, with China being the first.

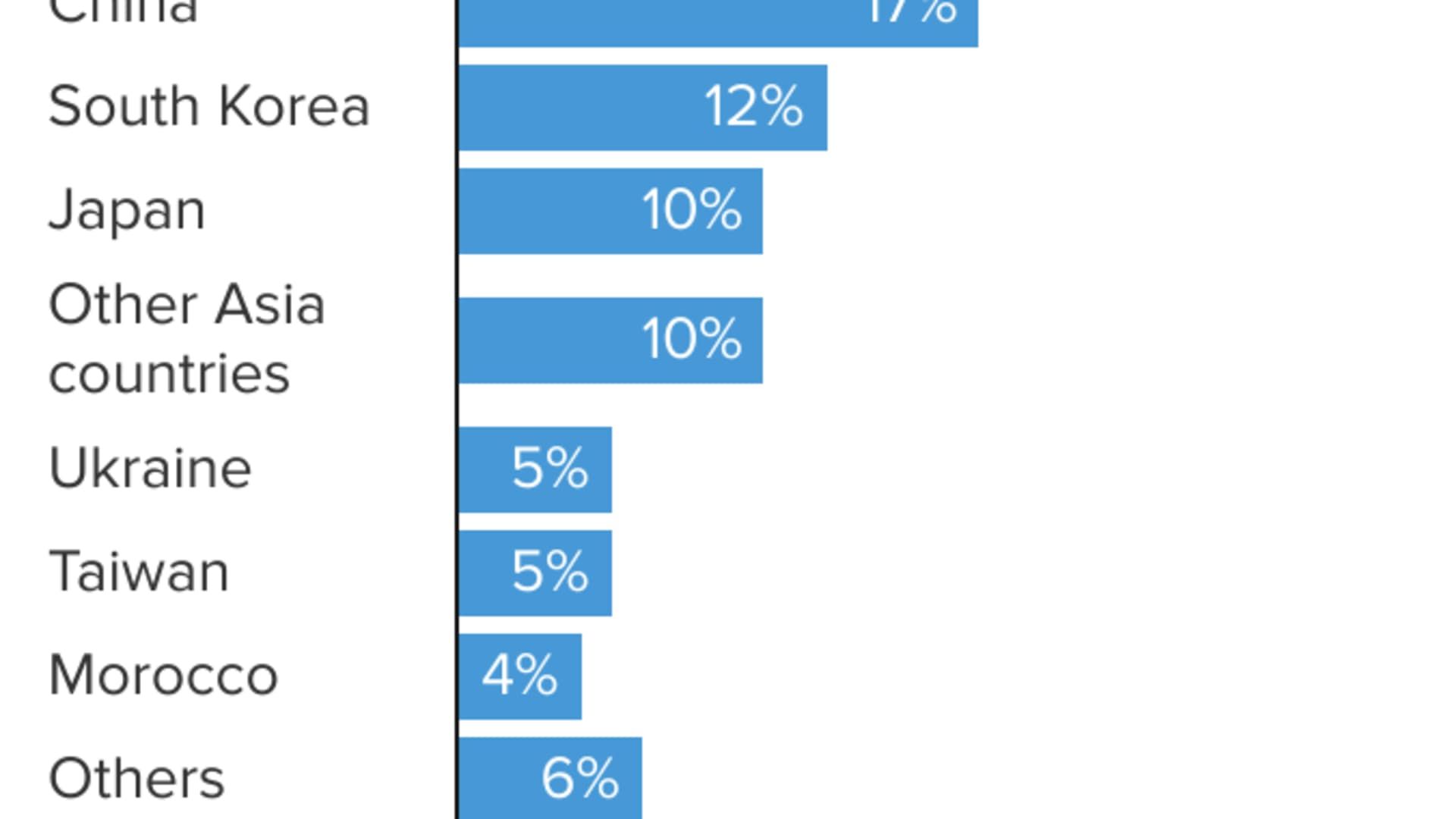

Russia is the sixth-largest coal producer in the world. In 2020, 54% of the country's coal exports went to Asia, while about 31% went to Organisation for Economic Co-operation and Development countries in Europe, according to the U.S. Energy Information Administration.

Doubling down despite 'warning shots' from U.S.

Before the war started, India bought very little coal from Russia, which accounted for only about 2% of India's overall imports in 2021.

"We are moving in the direction of importing coking coal from Russia," Indian Steel Minister Ramchandra Prasad Singh told a conference in New Delhi, according to Reuters. He said the country had imported 4.5 million tonnes of coking coal from Russia, but did not indicate which period.

"Despite warnings from the West, India continues to lean into their supply chain relationship with Russia for natural resources like oil and coal," said Samir N. Kapadia, head of trade at government relations consulting firm Vogel Group.

Kapadia said it would hinge on a currency swap agreement "to bypass some of the financing challenges in the market." A currency swap line is an agreement between two central banks to exchange currencies, set up to improve liquidity conditions and provide foreign currency funding to domestic banks during periods of market stress.

Such a mechanism would allow India to buy Russian energy exports and other goods — even with Western sanctions restricting international payment mechanisms.

Several Russian banks have already been cut out of SWIFT, a global system connecting more than 11,000 member banks in some 200 countries and territories globally.

"I don't think they can get around the logistical issues with shipping, but a rupee-rouble currency swap would help," Kapadia told CNBC in an email.

The U.S might consider sanctions and other measures on India if it doesn't curtail its purchases of oil and coal from Russia, said Kapadia.

"The White House has fired two 'warning shots' to date, pressuring India to be on the 'right side of history' and avoid aligning with Russia. There likely won't be a third if this persists," he said.

In recent weeks, top U.S. officials have reportedly warned New Delhi against a sharp rise in oil imports, Washington has warned that India will face significant consequences if it aligns itself with Moscow, according to reports.

India has also been snapping up cheaper oil from Russia as its purchases jump significantly, since the start of the war.

India's increasing coal dependence

India's coking coal import dependency has soared to around 85%, according to CBA's Dhar.

A mega trade deal it signed with Australia early this month may bring some relief, but even that might be limited.

"Australia just won't be in a position to supply India the additional coking coal tonnes it requires for its growing steel production fleet because supply growth will be limited," said Dhar.

Late last year, India was hit by a coal shortage as its power demand soared.

The only way is for Australia's coking coal exports to shift away from other countries so that India can claim a bigger share — but that's unlikely given that countries are now considering moving away from Russian coal, according to Dhar.

"Given that South Korea, Japan and Europe are looking to diversify away from Russia (~10% of global coking coal exports), it's even harder to build the case that demand for Australian coking coal will weaken from a major buyer in the foreseeable future," Dhar said.