- Home Depot beat earnings expectations but warned of a cautious consumer.

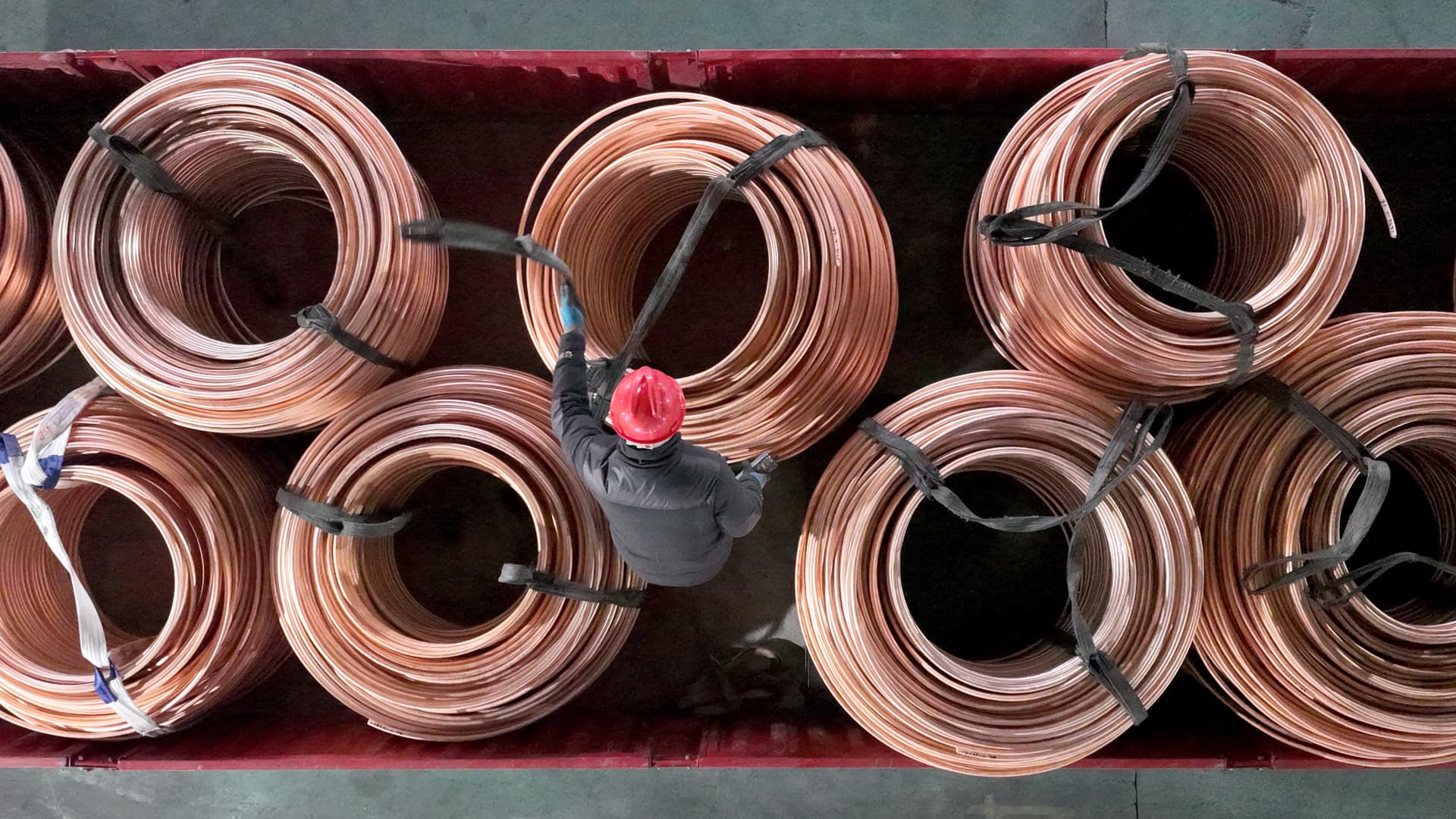

- Commodity prices have been falling over the past month.

- Consumers projected a more positive outlook on inflation.

Here are five key things investors need to know to start the trading day:

1. Minor momentum

The S&P 500 and the Nasdaq Composite managed to hold on to their upward momentum in Monday's trading session. The S&P 500 ended flat, up only 0.23 points, at 5,344.39, after moving back and forth between gains and losses all day. The Nasdaq, meanwhile, advanced 0.21% thanks to Nvidia climbing 4%. The Dow Jones Industrial Average was the outlier, pulling back 140 points, or 0.36%. Investors will be watching the producer price index — a measure of wholesale prices that's due out at 8:30 a.m. ET. A Dow Jones consensus estimate expects a monthly gain of 0.2% in July, in line with the previous month's reading. Follow live market updates.

2. Retail earnings

Get Tri-state area news delivered to your inbox. Sign up for NBC New York's News Headlines newsletter.

Home Depot kicked off a wave of retail earnings Tuesday by warning about a cautious consumer. The home improvement retailer beat quarterly expectations when it reported earnings before the bell, but it also cautioned that sales will be weaker than expected in the second half of the year. The company said it expects full-year comparable sales to decline by 3% to 4% compared with the prior fiscal year, worse than the decline of 1% it had previously projected. "Pros tell us that, for the first time, their customers aren't just deferring because of higher financing costs," Chief Financial Officer Richard McPhail told CNBC. "They're deferring because of a sense of greater uncertainty in the economy."

Money Report

3. Inflation anticipation

Consumers are starting to feel more optimistic about inflation. In fact, the New York Fed's Survey of Consumer Expectations put the three-year inflation outlook at 2.3%. That's down 0.6 percentage points from the June outlook, and is the lowest level in the history of the survey, dating back to June 2013. Put another way, respondents think inflation will stay elevated over the next year but then expect it to recede after that. Meanwhile, household spending is expected to increase by 4.9%, 0.2 percentage points lower than in June and the lowest reading since April 2021, which is roughly when the latest inflation surge started, according to the survey.

4. Under pressure?

Commodity prices have tumbled over the past month, even as stocks in the U.S. recovered many of their recent losses. Crude oil futures have dropped 14% from July 5 through Aug. 5 and copper futures are down nearly 12% over the past month. "In terms of commodities, the entire asset class is coming under pressure," Rob Ginsberg, managing director at Wolfe Research, wrote in a Friday research note. Those downturns might be a sign of underlying weaknesses in the global economy as commodities and copper, especially are often viewed as a signal of what is likely to happen with the economy, said Bart Melek, global head of commodity strategy at TD Securities.

5. Lifting anchors

Macy's plan to close roughly 150 of its namesake stores in the coming years will set off a wave of changes at malls. Its stores are anchors, with huge footprints that range between 200,000 and 225,000 square feet, that are often hard to fill with another large retailer. Some malls are turning them into smaller retail spaces, but others are getting creative with how they fill the gaps. At former Macy's locations that have already closed, malls have tacked on apartments, demolished the building for a completely new development or converted the space into warehouses, grocery stores, movie theaters and health-care facilities. "There's a collective challenge to get people off the couch and out of the house," said Adam Tritt, chief development officer for Brookfield Properties' U.S. retail portfolio. Read more about the changes coming to shopping malls here.

— CNBC's Brian Evans, Melissa Repko, Spencer Kimball and Jeff Cox contributed to this report.

— Follow broader market action like a pro on CNBC Pro.